The investment risk Hydra

Ancient Greek mythology speaks of the great hero Heracles (known as Hercules to the Romans); and of his twelve labours performed as penance. The second of his heroic labours was vanquishing the Lernaean Hydra, a serpentine monster with several heads each of which regenerated upon their decapitation. At the risk of stretching a metaphor beyond breaking point, managing investment assets for insurers is not unlike trying to vanquish the Lernaean Hydra. Insurance companies have to consider a range of risks outside ‘pure’ investment risk and return. This can sometimes feel like attempting to behead the Risk Hydra where success only results in another head being generated.

The many heads of the risk Hydra

Insurers of all shapes and sizes, across various jurisdictions, all face at least three Risk Hydra heads:

ECONOMIC RISK: risk inherent in any investment portfolio as measured/implied/priced by investment markets.

REGULATORY RISK: investment risk as measured by an insurance regulatory body (not necessarily the same as economic risk)

ACCOUNTING RISK: risk reflected in and impacting the insurer’s reports and accounts, resulting from the classification of specific investments or accounting treatment of the investment portfolio.

It is impossible to invest assets and completely eliminate or mitigate all of these risks. The challenge for insurers is to optimise their investment portfolio relative to the Hydra heads. However, this can be difficult for three reasons:

01 LIKE IN THE STORY OF HERACLES, THE RISK HYDRA HEADS DO NOT WORK INDEPENDENTLY

Often, by optimising a portfolio relative to one risk an insurer inadvertently reduces the efficiency of the portfolio relative to a different risk. For example, a portfolio that is optimised to reduce accounting profit & loss volatility, by holding large cash balances, may be very inefficient from an economic risk perspective (especially in an inflationary environment).

02 APPLYING A GENERIC APPROACH TO VANQUISHING THE HYDRA CAN RESULT IN A LOT OF EFFORT WITH LITTLE TANGIBLE RESULTS

Heracles attempted to merely chop the heads off the Hydra but they kept growing back much to his frustration. We would argue that many insurance decision makers find themselves in similar positions. An insurers response to each risk needs to be tailored to the issue at hand, while also being aware of the impact it might have on the other risks.

03 EACH INSURER WILL COME ACROSS A DIFFERNT RISK HYDRA THAT REFLECTS THE IDIOSYCRATIC RISKS THEY FACE

The Risk Hydra may also evolve and change over time as the insurer’s business and/or operating environment changes. For example, a small insurer may find themselves outside certain regulatory capital requirements due to rules around proportionality. However, as the insurer grows regulatory risk may become more of a concern.

For many insurers a tension will always exist as they battle the Risk Hydra. By focusing effort on one head the others may grow stronger and, in many cases, it’s not possible to fight all the heads at the same time and have meaningful success.

Which head should we attack first?

We’ve been discussing three heads here, but some insurers will find other heads are more relevant to them. For example, strategic risk where the investment portfolio is part of a larger stakeholder relationship which adds another layer of complexity. That said, in our experience for most insurers economic risk, regulatory risk and accounting risk are the most relevant risks that need to be considered when making investment decisions.

So, what kind of insurers, are likely to prioritise which of the Risk Hydra heads?

This framework may help insurers prioritise one area over another for immediate attention but applying a robust method of measurement and an understanding of risks across the board is still crucial. The implications of and exposures to each of the heads are much easier to identify when you’re actively keeping watch.

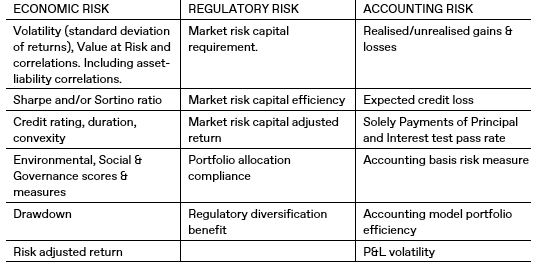

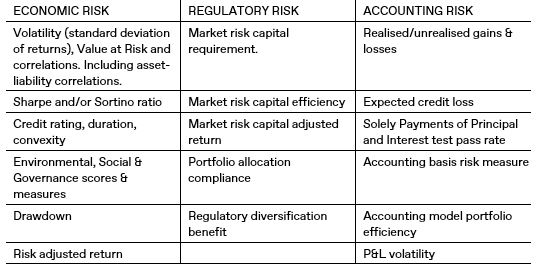

So how can insurers best use their limited resources to contain the Risk Hydra? A good place to start is by understanding how the heads are measured.

Your head is bigger than mine, or is it?

Most insurers have a sense of which risk to focus on at any one time. However, it’s a useful exercise to size each of the risks. We use a range of tools to measure the size of each head (and, in keeping with our theme, the lethality of each).

The table above is not an exhaustive list but captures the most common measures we come across and/or use in managing and monitoring insurance assets. The key to getting the most out of the measuring process is not deploying as many measures as possible, but rather prioritising the Hydra heads in terms of importance and identifying the measures that capture the most salient risks.

Case study: one insurer takes on the Hydra

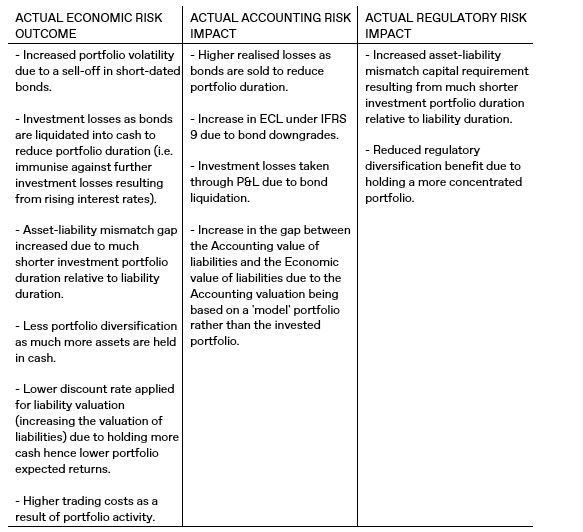

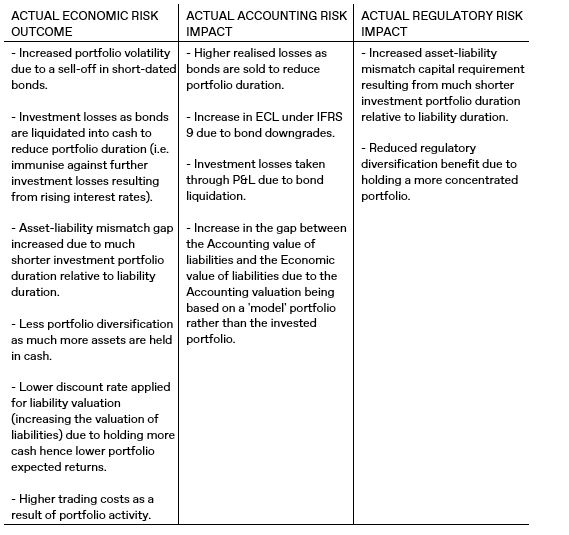

The example below illustrates some of the challenges arising from optimising insurance assets relative to a range of risks in practice. The insurer below held an investment portfolio that was initially structured to simultaneously tackle the Economic and Accounting risk heads over an economic cycle.

However, as inflation picked up and the Risk Hydra appeared to grow a fourth head (the dreaded inflation head), Central Banks tackled inflation by raising interest rates and markets reacted by selling quality short-dated bonds. The insurer in question then saw some unexpected behaviour in the portfolio.

A few simple actions recommended to improve the resilience of the portfolio, keeping in mind the Risk Hydra heads and their interactions:

Robust shock and scenario analysis from multiple risk perspectives

This should be done considering the impact of market shocks and scenarios on Economic, Accounting and Regulatory risks simultaneously and any correlations. This allows the insurer to build a clear picture of how the portfolio will behave and what that means for the Risk Hydra heads that are most relevant to them.

Structure investment portfolio in line with Accounting ‘model’ portfolio or vice-versa

Reduces the mismatch between the valuation of liabilities from an Economic and Accounting perspective which should make asset-liability matching simpler from both perspectives.

Consider buy-and-hold strategy during periods of market stress

Portfolio will benefit from the ‘pull to par’ dynamic of bonds as they approach maturity, reducing the investment losses in the portfolio assuming bonds have high enough quality to make the likelihood of default negligible. This also reduces portfolio turn-over and related trading costs, reduces realised losses reported from accounting perspective and maintains a high quality, diversified portfolio which should preserve any regulatory diversification benefits. Make use of derivative strategies to manage portfolio duration.

Flexibly reduce portfolio duration as rates rise without deploying large amounts of capital to buy or sell bonds

More capital can be used to invest and/or pursue a buy-and-hold strategy. Derivative P&L will have to be carefully managed to ensure it does not significantly impact on accounts and derivative counter-party exposure (depending on the credit rating of the counterparty) is something to be aware of.

Summary

Spoiler alert, Heracles battled the Hydra and was successful thanks to some ingenuity and help from some friends. Although insurers are unlikely to completely vanquish the portfolio Risk Hydra, they can use investment strategies and approaches that can better contain and mitigate the Risk Hydra heads.

Understanding which head to tackle, when to tackle it and the best way to make an impact is half the battle, and with some help from your asset management friends the Risk Hydra can be kept under control.

At London & Capital, our torches burn brightly and we’re always ready to help insurers with their heroic labours! Please get in touch if we can help.