For P&C insurers operating today, managing evolving investment risk, and accurately assessing your asset-liability risk profile, have quickly risen up the list of internal challenges and priorities. For some insurers, traditional measures of risk seem to paint a very different picture from the risk experienced over the last decade. Indeed, the re-emergence of noticeable investment market volatility coupled with extremes in claims experience (both benign and accelerated, depending on geography and lines underwritten) has made the business of insurance much more exciting than it ought to be.

For many insurers, Value at Risk (VaR) is one of the primary tools used to measure and assess both asset and liability risk. A question worth pondering is how effective VaR has been over the most recent crisis and what, if any, implications does this have for investment risk management going forward?

What is value at risk?

VaR is a measure of the maximum expected loss over a given period and at a pre-determined level of confidence. For example, if the 95% one-year VaR measure for a portfolio is £1m, we should be confident (to a 95% confidence interval) that over a one-year period the portfolio wouldn’t suffer any more than £1m in investment losses.

VaR measures can be calculated based on historical data (ex-post) or forward-looking modelled data (ex-ante). An ex-ante VaR calculation is often done by simulating expected returns of assets based on assumptions about asset class correlations and expected performance.

| Features of Value at Risk | |

| Backward-looking VaR | Forward-looking VaR |

| – Reflects historical features of investment markets.

– Requires historical return data of sufficient granularity. – Useful for evaluating historic risk but may give unclear expected risk especially if investment markets are changing. |

– Assumed future performance and correlations of asset classes.

– Requires a performance simulation engine. – Performance simulation is sometimes calibrated using past returns. – Useful for estimating future investment risk and return. |

VaR is useful because it allows an insurer to assign a specific value to the risk of investment losses. In addition, VaR measure and methodology can also incorporate a set of underlying assumptions defined by the insurer and specifically tailored to their business.

Given that risk analysis and data are the building blocks of the insurance business, VaR can allow the insurer to aggregate a whole host of potential risks and outcomes into a single measure. VaR, as a tool, benefits from this simplification but is an easily quantified measure and runs the risk of over-simplifying some statistically complex relationships.

CASE STUDY: how has var performed as a measure of risk following the covid crisis

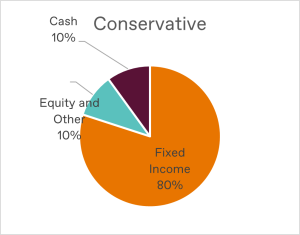

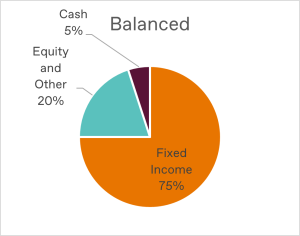

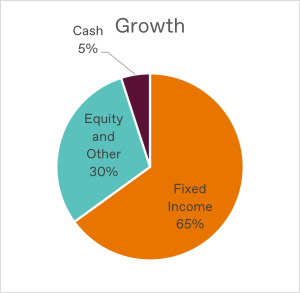

To look at how effective VaR has been over the past two years, we’ve assessed a range of insurance portfolios with varying levels of risk; a Conservative, a Moderate and a Growth-orientated portfolio. These insurance portfolios represent real-world portfolios held by insurers with different risk appetites.

Source: London & Capital and Bloomberg

Source: London & Capital and Bloomberg

Source: London & Capital and Bloomberg

We reviewed these portfolios and measured the risk using the two different measures of VaR:

- Historical VaR (based on historical, actual asset returns); and

- Forward looking VaR (based on modelled expected asset returns).

Backwards looking returns were simply taken from historical market data. Forward looking returns were generated using a ‘Monte-Carlo’ model that simulated a range of possible return outcomes across a range of potential scenarios.

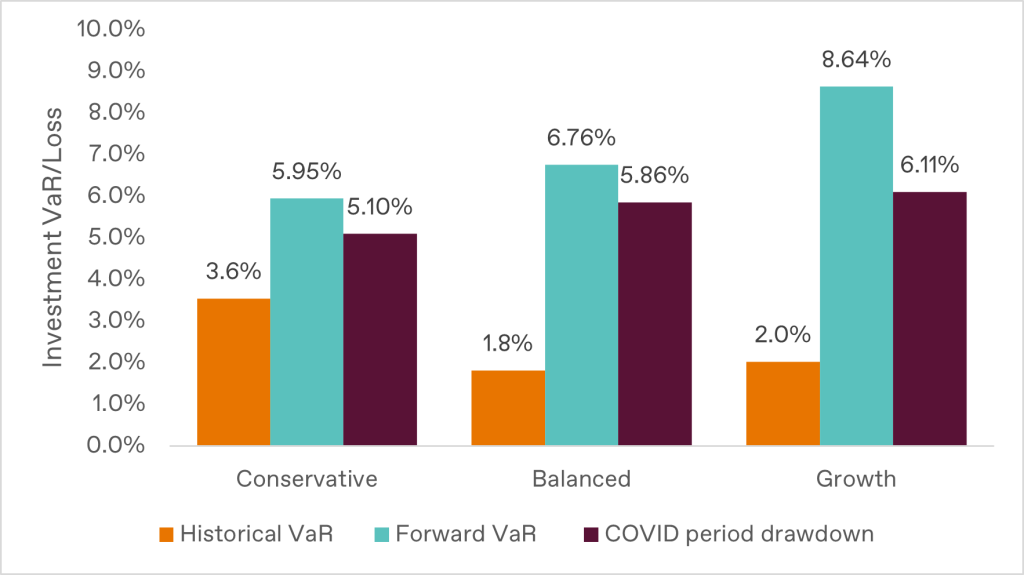

The charts below summarise the pre-COVID and post-COVID VaR measures for these three insurance investment portfolios and the worst drawdown suffered during the COVID crisis. In putting this work together, we’ve assumed a 95% confidence level over 12 months (that is, the VaR represents the worst loss expected over a 12-month period with 95% confidence).

Source: London & Capital and Bloomberg

Interestingly, VaR appears to have been either effective or ineffective depending on the type of methodology used.

The historical VaR produces a mixed performance with inconsistent results across risk profiles. Importantly, it persistently under-estimated portfolio risk relative to the real-world losses that were experienced during the Covid-19 market volatility. A notable contributor to this chronic under-estimation of risk may have been the historically low market volatility that preceded the outbreak of Covid-19. Supressed market volatility likely gave a false impression of the level of investment risk inherent in portfolios. As we know from every investment-related advert, past performance does not guarantee future results.

By contrast, the forward-looking VaR methodology proved to be a more realistic measure of portfolio risk, even though it over-estimated losses relative to the experience of returns in the depth of the Covid-19 crisis. Insurers regularly measuring portfolio risk using this forward-looking metric will have theoretically been well prepared for the aftermath of the virus outbreak as actual losses for these portfolios consistently fell near the 95% VaR measure. Insurers who were using that forward-looking VaR measure and were holding a buffer against losses larger than the 95% mark, will have likely weathered the market turmoil with some confidence. For example, European insurers under the Solvency II regime are required to hold a 12-month VaR buffer but to a, higher, 99.5% confidence level, which will have provided all the protection needed during 2020.

During this episode of market volatility, even simplistic VaR measures may have been a useful tool for assessing insurance investment portfolio risk. However, the devil is in the detail as historical VaR measures would have underestimated portfolio risk given the reliance on historical results and the recent benign market environment. Forward-looking measures may have been more useful on the face of it but different underlying assumptions about the statistical features of asset returns may produce very different results.

It is important to remember that for insurers investment losses are not considered in isolation rather their significance is evident once the underwriting loss impact is understood. The interaction between the market VaR and any liability VaR, is important. For example, motor insurers who would have likely had a benign underwriting loss year in 2020 will have negated some investment losses through underwriting profits. Hence any market VaR buffers that may have been breached following Covid-19 will have been partially smoothed out by a better-than-expected underwriting year. This principle applies to all insurers. When VaR limits are being assessed a clear understanding of asset-liability correlation is important to ensure the aggregated VaR measure is a reasonable one.

What does all this mean for insurers

Although we have taken an isolated, and previously unprecedented, event and used some common investment risk measures, it’s worth noting that even in these circumstances VaR would have provided a useful risk marker.

Some key take-aways for insurers looking to incorporate risk analysis into their own reporting include:

01 Measuring investment risk in a variety of ways is likely to provide a clearer view of portfolio risk. Don’t rely on a single risk metric.

02 Keep in mind the strengths and weaknesses of any risk measure and adjust for these where possible. In the case of VaR, be mindful of the potential implications of statistical assumptions and the data feeding into the measure.

03 Understand the prevailing market environment in which a risk measure is being calculated. For example, using data over a period of benign risk may paint a misleading picture and vice-versa.

04 Ensure that a view of the aggregated VaR measure across both asset and liabilities is sensible. A study of asset-liability correlations may be useful in achieving this.

Insurers should be working closely with their asset managers to understand any risk measures being produced and ensure the measures being used capture investment risk as best as possible. Insurers should also work with their asset managers to capture any correlations between assets and liabilities and ensure reasonable buffers are in place at the aggregated risk level. All risk measures should be reviewed regularly (at the least annually) to ensure they remain relevant to your insurance business and the broader investment environment.

London & Capital works with large and small insurers in the UK, Europe, Bermuda, the US, and the Caribbean to help them identify and understand the most effective risk measures for their business. For further information please do not hesitate to contact Shadrack Kwasa and the wider Institutional team at London & Capital.

To speak to the Institutional Team or to Shadrack Kwasa, please give us a call on +44 (0) 207 396 3388, alternatively email insurance@londonandcapital.com or get in contact here.