Strengthening your armour

In previous instalments of our Greek mythology series, we explored the similarities between investment risk and the Lernaean multi-headed Hydra (see link). We also looked at the ancient Greek poem The Shepherd and The Sea and what that teaches us about active vs passive investing for insurers (see link).

As 2023 has rolled on and we have had the most acute changes in interest rates since the Financial Crisis. I am reminded of one of the most famous battles in Greek mythology, the Trojan war. In this story our hero (or villain depending on your allegiances) Achilles is about to battle a formidable enemy, the undefeated Greek hero Hector. Fearing for her son’s safety Achilles’ mother Thetis enlists the Greek god Hephaestus to forge a magnificent armour to enhance Achilles strength and protection.

This story has surprising parallels to challenges that insurers are currently facing in managing fixed income portfolios as interest rates and bond yields steadily rise. Insurers need to consider how to not only enhance the protection against rising yields in their portfolios but also how to benefit from the opportunity this presents.

Preparing for battle

In a market where fixed income is volatile, insurer’s investment portfolios will usually follow suit as fixed income tends to dominate allocations. Insurers often look at duration as the key measure of interest rate sensitivity in their investment portfolio. The longer the portfolio duration, the more sensitive the portfolio to changes in rates.

However, what is sometimes not fully appreciated by Insurance Boards and senior management is that duration only provides a measure of sensitivity of the portfolio to small changes in rates. If the changes are large and sustained, duration will likely not provide the full picture. Furthermore, if an insurer is engaged in asset-liability management and is relying on duration matching of assets and liabilities more issues may result from not fully mapping out the relationship between duration and balance-sheet sensitivity.

Insurers may need to behave like Thetis and find ways of strengthening their armour in anticipation of challenges to come. A question worth exploring is if duration is not a strong enough armour, what can Hephaestus forge that is stronger?

Convexity, the upgrade to duration

In the same way that duration measures a fixed income portfolio’s sensitivity to small interest rate changes, convexity measures sensitivity to larger changes. But what do we mean by small and large changes?

In the same way that duration measures a fixed income portfolio’s sensitivity to small interest rate changes, convexity measures sensitivity to larger changes. But what do we mean by small and large changes?

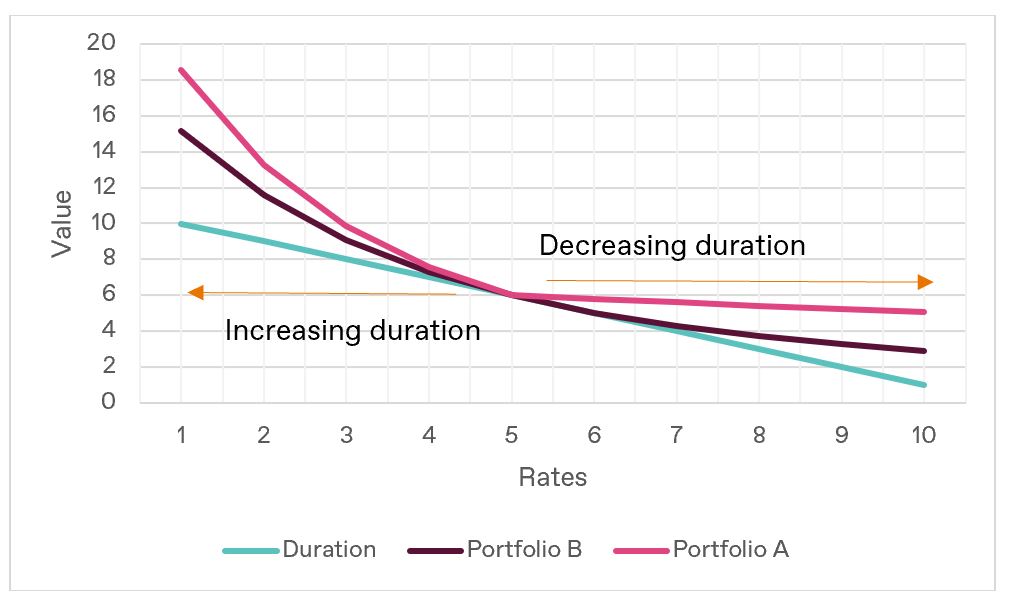

The figure illustrates the significance of convexity in this context. Duration implies a linear relationship between changes in a fixed income portfolio valuation and changes in rates. For small changes in rates, assuming a linear relationship is often sufficiently accurate.

However, the true relationship between fixed income prices and rates is non-linear as illustrated by the curved lines. As changes in rates become larger, the difference in expected valuation (assuming duration is used to predict the change in valuation) and the market valuation can vary dramatically. The curvature of this relationship is what is known as convexity.

An intuitive way to think about this is that duration is the degree to which the curve slopes at a particular interest rate. In our example above, as rates move towards 0%, the curve slopes steeper. This implies duration increases since the steeper the curve, the higher the duration. As rates move in the opposite direction, towards 10%, the curve gets flatter, implying duration is decreasing. This type of behaviour is described as positive convexity and is displayed by ‘vanilla’ fixed income securities (i.e. straight-forward bonds where there are no additional options, call dates etc. included in the terms of the bond issue).

And so, in a portfolio of standard bonds, as rates fall (all other factors remaining equal) we would expect duration to increase enhancing the returns on a fixed income portfolio, relative to the straight line duration, as the portfolio becomes more sensitive to rate changes. On the other hand, as rates rise the portfolio becomes less sensitive to rate changes reducing the losses from falling valuations relative to the straight line duration. The value of the portfolios is always above the value implied by the straight line duration.

In our example above, we have portfolios with different convexity. The more convex portfolio (Portfolio A) is arguably better interest rate hedged than the Portfolio B. That is, regardless of the movement in rates Portfolio A always outperforms Portfolio B (other factors remaining equal). You can quickly see that convexity can be a powerful tool in driving out-performance in a volatile rates environment.

If my portfolio value is always higher than expected, what’s the problem?

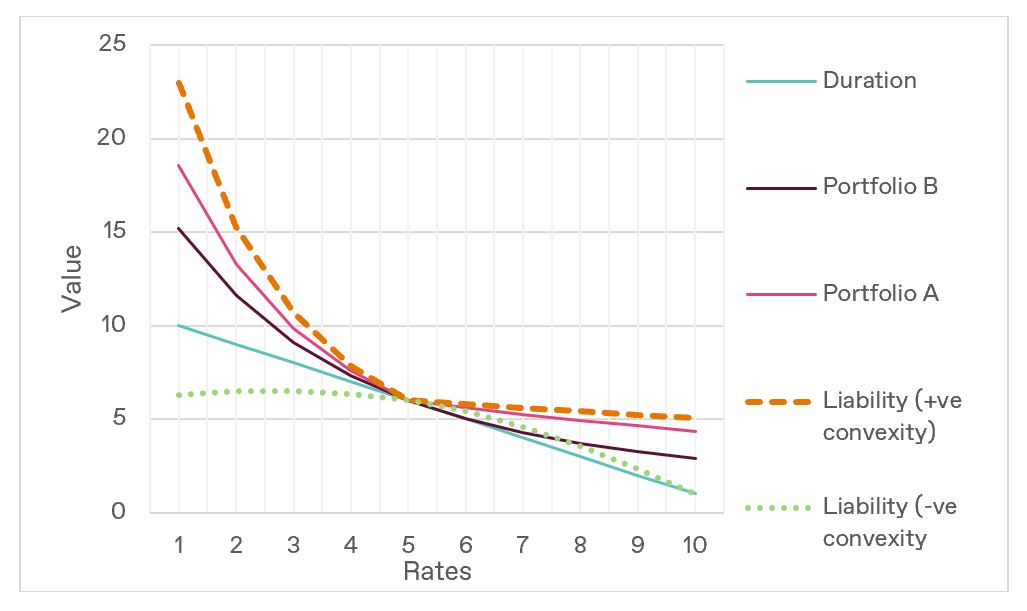

The challenge facing insurers is investment portfolios (fixed income portfolios in particular) are not held only to produce a return on capital. They perform other key functions, including actively matching liabilities against assets. For portfolios that are held to also match the liability profile, large changes in interest rates can quickly result in asset-liability mismatches.

To illustrate the impact this scenario we can see below that if the insurance liability profile has higher convexity than the matching asset portfolio (orange line) then a mismatch will inevitably emerge, regardless of the movement in rates. In this case merely matching duration does not immunise against asset-liability mismatches and the liability valuation remains higher than the portfolio valuation.

On the other hand, for liabilities that have negative convexity, most vanilla fixed income portfolios will remain above the liability valuation (other factors remaining equal).

Liability convexity will be driven by policyholder behaviour and the underlying macroeconomic environment that is driving changes in interest rates. For example, in a rising rates environment some policyholders may be incentivised to lapse on their policies (reducing liability duration) while others may be incentivised to make claims on certain policies (increasing liability duration). Fixed income securities can be chosen to manage convexity as well as duration through analysis of maturity profile, coupon payments, spread risk, credit risk and a host of other fixed income characteristics.

Someone ask hepheastus to forge a stronger armour

Achilles went on to battle Hector and was victorious in no small part thanks to his magnificent armour. He did also have some help from the gods but I will leave the details for you to research in your own time. Insurers can similarly be better equipped to tackle a volatile investment market if they have the correct armour in place.

An understanding of a fixed income portfolio’s convexity is important in performance and risk management. Especially in an environment where interest rates and bond yields are expected to shift significantly. For insurers, this is even more important as the convexity of the portfolio relative to liabilities is key in asset-liability management.

Although Achilles was victorious in this instance, he did eventually suffer a spectacular defeat due to a major design flaw in his magnificent armour. Achilles armour did not protect Achilles heel. Insurers need to be careful and considered in the way they use the investment tools as even the best armour can be rendered useless if they do not protect against material risks. We will be exploring this idea in a future instalment of our journey through Greek mythology.

London and Capital can help

We have experience exploring all these issues with insurers and building robust portfolios to weather challenging fixed income markets. Whether you are considering strengthening your current armour or have concerns about the impact of rising rates on your insurance portfolio, we would be glad to be a Hephaestus in your battle.