Insurers are naturally fixed income investors but we’ve increasingly seen a trend towards diversification.

However, Captives with their smaller capital bases versus their commercial peers, have less investment flexibility than most insurers. While MassMutual made headlines in Q1 2021 for jumping on the Bitcoin bandwagon (or revolution, depending on your outlook!), most Captives simply don’t have the capital capacity or risk appetite to even explore the most mainstream of ‘alternative’ assets (broadly any kind of asset that doesn’t fit the traditional mould of a cash, fixed income or equity investment).

As we know from Captive industry surveys, such as the annual Marsh report, the average asset allocation for Captives is typically 40% cash and intercompany loans, 50% fixed income, 10% equities and alternatives. While averages clearly gloss over important details (on average a room full of insurance professionals plus Bill Gates is a room of millionaires, add in Elon Musk or Jeff Bezos and we have a room of billionaires), the core point remains an important one – Captives’ core exposure is in the fixed income markets, an area of the market that has seen a 35-year tailwind with global interest rates headed in only one direction.

Calling an end to this incredible run of performance may well be premature but since the start of 2021, fixed income investors the world over have seen a huge shift in expectations, and consequently fixed income yields. As financial markets look to put the pandemic behind them – even despite the resurgence of COVID-19 we’ve seen in Europe. Looking forward, investors are looking to set expectations around what the future economic conditions might look like.

Should we all be looking forward to the roaring 20’s or is a return to post-Great Financial Crisis conditions more realistic?

The answer to this question is critical as it sets the scene for inflation, employment, capacity in the system and, ultimately, interest rates. Will we see inflation race ahead beyond the cherished 2% target in developed economies? Will that spur growth rates beyond the average rates we’ve seen in the past 10 years? How quickly will the Federal Reserve (Fed) and other central banks adjust interest rate policy to reflect the new environment?

How has the market responded?

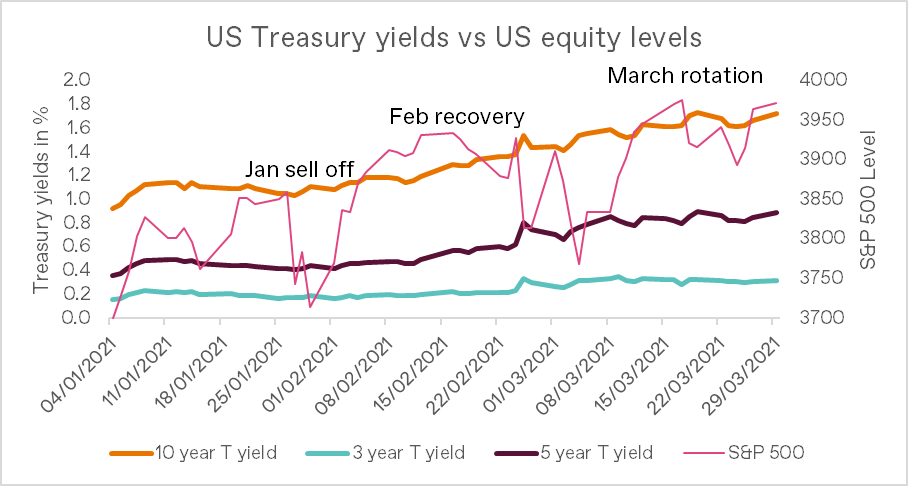

As divergent views on all these questions have emerged, markets have responded by pushing up bonds yields (and therefore pulling down bond prices) from historic lows in Q4 2020 to pre-pandemic levels today. What’s more, volatility has picked up across the board as the speed of these changes has surprised market participants across the world.

Equity markets took the opportunity again to underline their importance as a key diversifying asset class for insurance investors this quarter. Although Equities have posted another period of positive returns, the mood music has changed a lot! The first quarter has seen big ‘rotations’ in investor allocations and therefore large performance disparities between sectors.

Source: London & Capital, Bloomberg

In January, after a strong first few weeks of the New Year, the equity market sold off aggressively on concerns of exuberance and excessive valuations. The market then settled higher in February but in March, the rotation from growth stocks into cyclical value stocks accelerated rapidly as US sovereign bond yields spiked higher – impacting the ‘risk free’ rate of return that global investors use in their valuation models.

For equities, the improving growth outlook resulted in one of the largest accumulated earnings ‘beats’ versus expectations in history and forward-looking earnings statements confirmed a strong rebound from the depressed levels of 2020 as vaccines are rolled out globally and economies are reopened. Earnings season also confirmed that many corporates have structurally lowered their cost bases, boosting expectations for future profit margins.

We can’t talk about Q1 2021 equity markets without mentioning the spectacular emergence of the retail investor. The recent Gamestop saga, which was driven by the collaborative action of thousands of retail investors on Reddit’s WallStreetBets forum, resulted in one of the more memorable explosions in short positions seen for some time. Action from Regulators as well as social media and investment platforms is likely to curb this type of action in the future but the impact on markets of the active retail investor is certainly a feature that will have to be considered going forward.

From a fixed income perspective, the rise in longer-dated bond yields this year has taken them back to pre-pandemic levels in the US and Europe has been achieved relatively painlessly (versus previous episodes like the 2013 ‘taper tantrum’) with risk markets performing well, the economy getting stronger, inflation well behaved and bond markets functioning efficiently for both issuers and investors. The steepening yield curve has been tolerated so far but the suspicion is that if the US 10-year moves towards 2% the Fed is likely to intervene indirectly through switching bond purchases towards the longer-end to ensure that the Fed’s targets are met. Central banks across the globe are likely to take the lead from the Fed. This form of yield curve control will feature as a key tool to support broader economic measures.

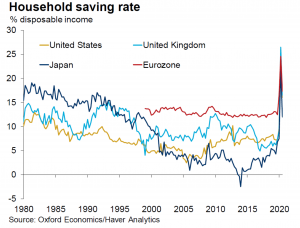

Switching focus to corporate bonds, we have seen all this activity result in positive performance from sectors that traditionally benefit when rates begin to rise. Banks are obvious beneficiaries of rising rates due to their business model (borrow at short-term rates and lend at long-term rates). The so-called ‘cyclicals’, such as autos, have also benefited from pent up consumer demand as huge savings piles built up over lockdowns are being put to work.

A combination of negative real interest rates, large savings and easing of lockdown restrictions should mean more spending by consumers and better earnings from consumer-cyclical sectors of economies across the globe.

What does all this mean for Captives?

The running theme for the quarter and indeed for the rest of the year is interest rate action and inflation. For Captives, this means portfolio sensitivity to interest rates is likely to be a key source of risk and return and must be understood, monitored and controlled.

Sector exposure will also be important to benefit the most from a Captive investment portfolio. This will be especially relevant for Captives whose parent companies’ are in sectors that may suffer from rising interest rates or where there may be a doubling of risk from insurance underwriting into less favourable sectors. Ensuring portfolio risk is sufficiently diversified through exposure to sectors that should perform well in a recovering environment should make Captive balance sheets more robust.

Originally published in Global Captive Podcast Insights Magazine. Please find the original article here.

To speak to the Institutional Team or to Shadrack Kwasa, please give us a call on +44 (0) 207 396 3388, alternatively email insurance@londonandcapital.com or get in contact here.