In this month’s edition of the roadmap, Joshua Moss sits down with Olivia Jackson, Portfolio Manager on the US Team at London & Capital to discuss how swings in exchange rates can have a significant impact on returns if not accounted for within a strategy.

The purpose of any portfolio is to grow in value over time and/or generate an income. It is therefore essential that a “reference currency” is considered, from both an investment and lifestyle perspective. Without the ability to be able to predict exchange rates, we must analyse the cost of missing out on a well-diversified portfolio against requirements for income.

For an international American family residing in the UK, the determination of a reference currency can be a difficult process as typically, assets will have been accumulated in different countries without the foresight of where one might reside in the medium-longer-term. This is usually because salary is based on country of residence; retirement pots must be qualifying in their jurisdiction and any gift/inheritance is usually received in the currency of where the donor/settlor resided.

01 Currency Risk

Also known as exchange rate risk or FX risk, this can be defined as the risk that investors’ assets will be negatively affected by currency depreciation. Since currency rates are constantly changing, investors trading in different currencies should take this into account when making foreign investments.

Please note, the examples we use are purely for illustrative purposes to show the concept of FX rate fluctuations.

- A client approaches us with £1,000,000 to invest. They are living in the UK and require a GBP income.

- If this immediately FX’ed into USD, they would have a portfolio valued at $1,210,000 based on the rate as of 17th August 2022 of 1.21.

- Fast forward 5 years let us say the GBP strengthens against the dollar to 1.50.

- Assuming the portfolio is still in the same position after 5 years, it will be worth $1,210,000, but drastically decreased to £806,666 due to the FX rate changes.

02 Currency movements and Tax

Currency movements give rise to gains or losses within portfolios, and this creates tax consequences. We can explain this concept with an example.

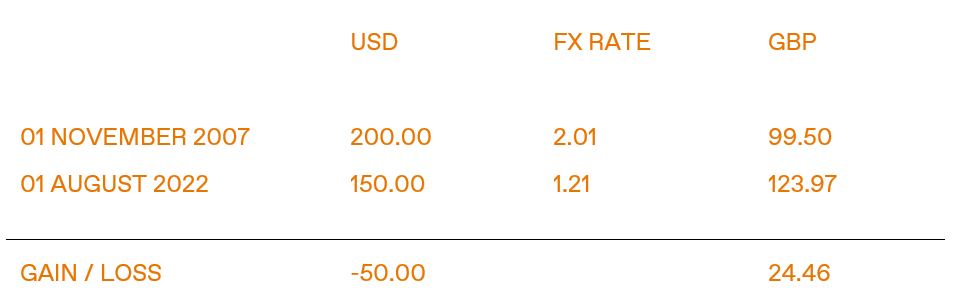

Over the 15-year period of ownership the equity has gone down in value in USD terms by $50. The strengthening of USD against the GBP has led to an overall gain on the asset in GBP terms of £24.46.

For UK tax the realised gain is subject to capital gains tax, for US tax this is a loss, so no tax is due. It is important when investing in multiple currencies to ensure both the asset return as well as the currency return is used to calculate the capital gain/loss on an asset for each tax jurisdiction.

HMRC (Her Majesty’s Revenue and Customs) only speak in GBP and the IRS (Internal Revenue Service) in USD, so any financial activity must be undertaken and reported on with both in mind.

03 Investment strategy?

We must consider how the currency comes into the investment process:

- The portfolio must be able to provide you with distributions in whatever currency is desired. Understanding your short-term (such as daily expenditure); medium/long-term (such as retirement expenditure) allows you to ascertain how much risk you have to currency swings.

- The currency impact inherent in global investment choices. To ensure the portfolio is well-diversified and/or investment opportunities are taken advantage of, it may be prudent to hold assets in a different currency to your “reference currency.” This will allow you to tap into a much larger universe of potential assets to purchase.

04 The Fund Problem

US/UK investors will struggle to find collective investment vehicles that do not attract punitive tax consequences.

Funds

The universe of options that do exist in this space are denominated in USD. For investors currently living and planning to stay in the UK, an investment portfolio of only USD assets introduces a mismatch between the currency their wealth is growing in compared to the currency they plan to spend those funds.

This mismatch makes the investor vulnerable to currency movements. When the USD is performing well against the GBP, the portfolio profits on the mismatch and is worth more to the GBP investor. This has been the case in recent times. However, the opposite is also true; when the USD is falling against the GBP, the sterling investor is losing value in their portfolio. In either case, currency markets are difficult to predict, and the movements can be severe so the mismatch must be managed.

Our solution? Direct investments.

Direct investments

Investing directly (as opposed to utilising collective vehicles) mitigates the tax issues as well as giving additional control on the currency exposure we are taking on. The currency effect is more severe for certain asset classes than others.

By buying direct fixed income names, we can select investments in the same currency as the clients “reference currency” so the risk is negated, and the income received does not fluctuate. As for the higher return profiles associated with assets on the equity side, the currency risk becomes less pronounced. This means that we can choose to invest in equity markets which we feel offer higher investment opportunities, rather than currency driving the decision.