As you plan for retirement, it’s essential to understand how Individual Retirement Accounts (IRAs) and Required Minimum Distributions (RMDs) work.

Key Terms

Before we begin, let’s define a few key terms to set the stage:

Traditional IRA – a tax-deferred retirement account where contributions may be tax-deductible, and withdrawals in retirement are taxed as ordinary income.

Roth IRA – a retirement account where contributions are made with after-tax dollars, but qualified withdrawals are tax-free.

401(k) – an employer-sponsored retirement plan that allows employees to contribute pre-tax income, with taxes due upon withdrawal.

RMD (Required Minimum Distribution) – the minimum amount that must be withdrawn annually from certain retirement accounts starting at a specified age. These rules ensure that retirees eventually begin withdrawing — and paying taxes on — money they have saved in tax-deferred retirement accounts. Recent changes from the SECURE Act have shifted the landscape, especially for inherited accounts.

How RMDs Are Calculated:

The IRS uses mortality tables — specifically the Uniform Lifetime Table — to determine how long you’re expected to live and spread your withdrawals accordingly. Each year, your account balance is divided by a number based on your age. As you age, this number gets smaller, so your RMD amount increases.

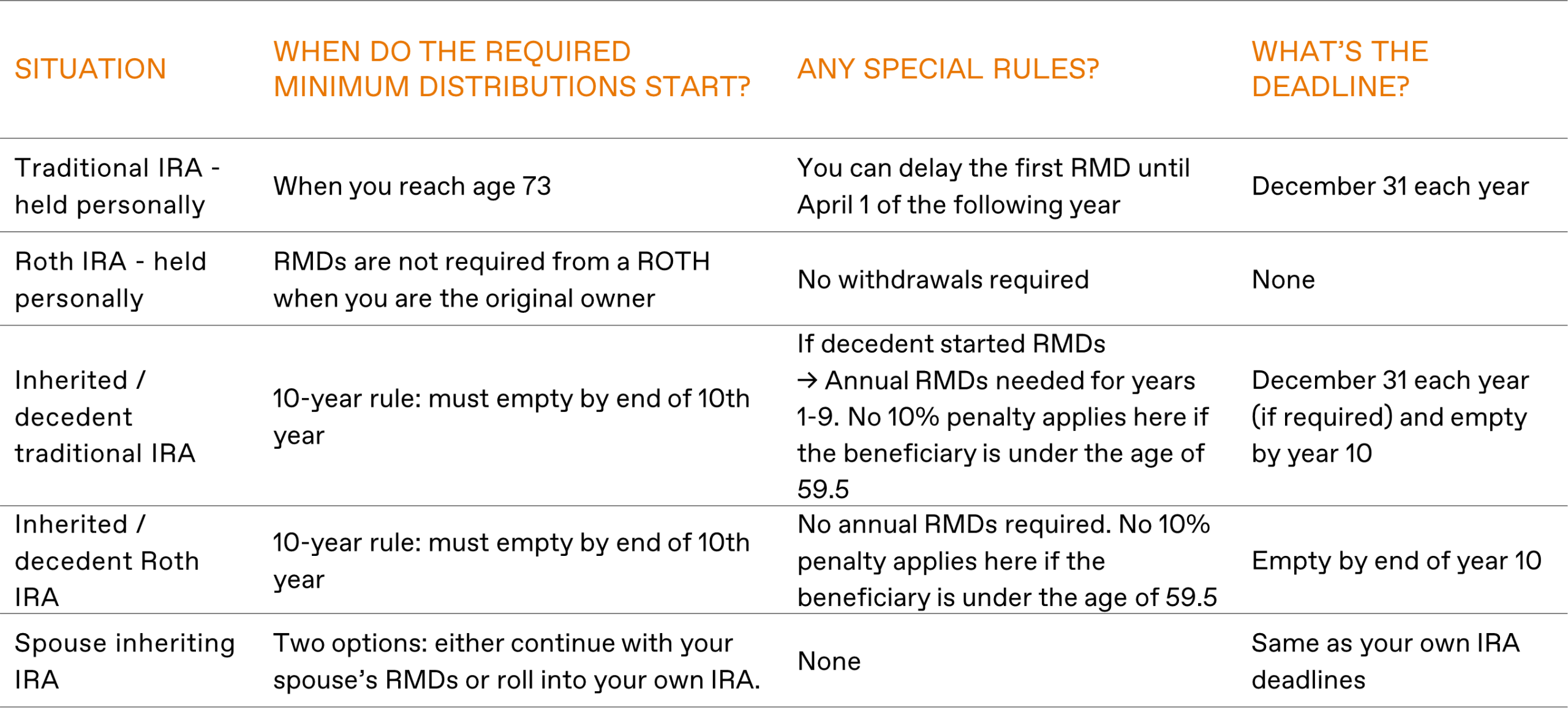

RMD Cheat Sheet

To help understand the basic rules on RMDs, we have put together a handy cheat sheet.

Final Thoughts

RMDs are a key part of retirement planning. Failing to take them on time can lead to hefty penalties — up to 25% of the missed amount (reduced from 50% under SECURE Act 2.0). Understanding when and how much to withdraw based on your situation is crucial, especially with changing rules and exceptions.