FX HEDGING ASSET EXPOSURE

In the last 6 – 12 months we have seen a torrent of activity as Central Banks have worked, arguably unsuccessfully, to use interest rates to control inflation. Given recent geopolitical events the drivers of inflation seem to have shifted away from local demand and supply dynamics into global supply side pressures. However, this has not deterred Central Banks from raising interest rates in an attempt to curb whatever demand-side drivers of inflation exist. A fallout from the flurry of rates activity has been notable relative interest rate shifts, that present interesting opportunities for the savvy investor. Specifically, in the FX market where a theoretical opportunity exists to take advantage of the impact of changes in relative interest rates on the exchange rates for major currencies.

For conservative investors such as insurance companies, playing the currency market is likely to push investment risk appetite beyond breaking point. A question worth pondering however is whether opportunities exist to exploit dislocations in interest rates to take hedged or unhedged positions in traditional asset classes such as bonds and equities. We explore this question after setting out some ground rules.

ASSUMPTIONS

In our analysis we have assumed the position of two insurance companies;

- Insurer 1: Liability duration of 3 years denominated in the base currency Pound Sterling

- Insurer 2: Liability duration of 3 years denominated in the base currency Euro

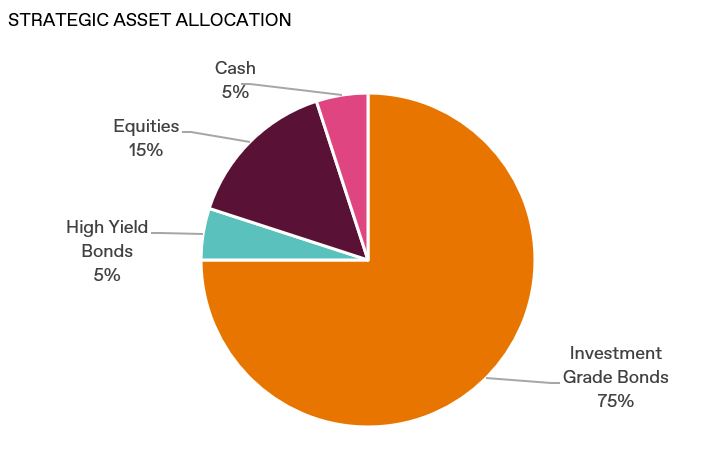

For simplicity we have also assumed the insurers’ strategic allocation as per the pie chart below.

We assume portfolios are rebalanced back to the strategic allocation every 6 months. In addition we assume solvency capital is calculated using standard formulas and that the cost of capital of the insurers is 6% p.a.

Finally, we assume the fixed income portion of the portfolio targets an average A credit rating for the portfolio and that all hedging costs are essentially frictionless, that is, the transactional costs of setting up any FX hedging instruments is negligible.

THE ARGUMENT FOR FIXED INCOME

To explore this question from a fixed income perspective we assumed each insurer holds assets in their base currency and duration match their liabilities using their fixed income portfolio.

The USD fixed income market is attractive to both GBP and EUR fixed income investors due to its relative depth and the broader issuance across bond maturity profiles and sectors. Over the last 3 years, bond yields have generally been higher in the US market compared to the EUR and GBP market.

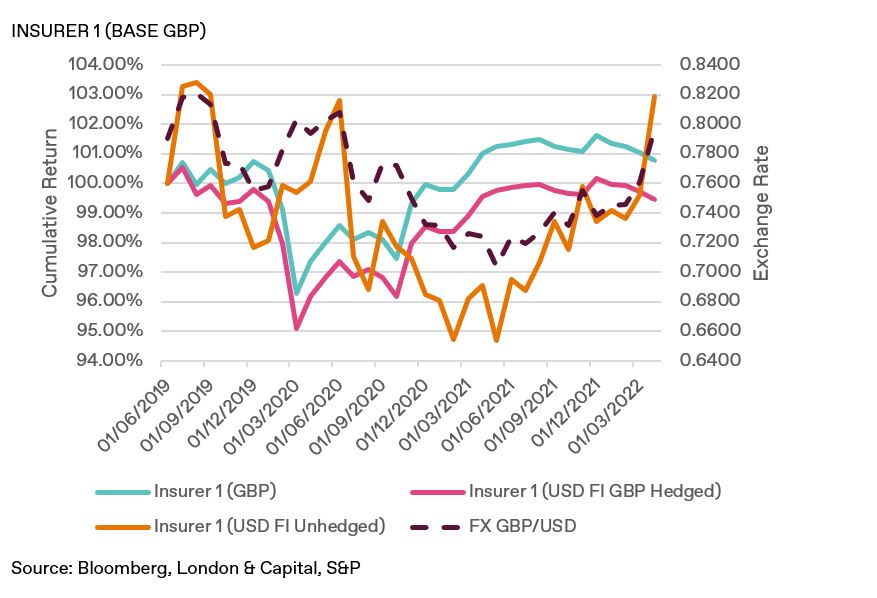

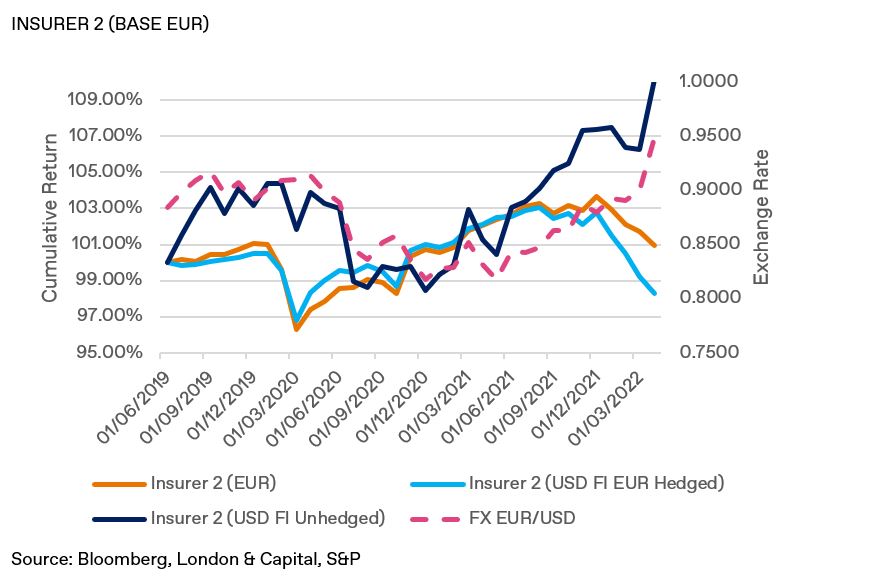

The chart below illustrates three scenarios playing out over the last 3 years for each insurer:

01 The insurer invests all assets in their base currency market.

02 The insurer invests all fixed income in the USD market but fully hedges out the currency risk.

03 The insurer invests all fixed income in the USD market with no currency hedging

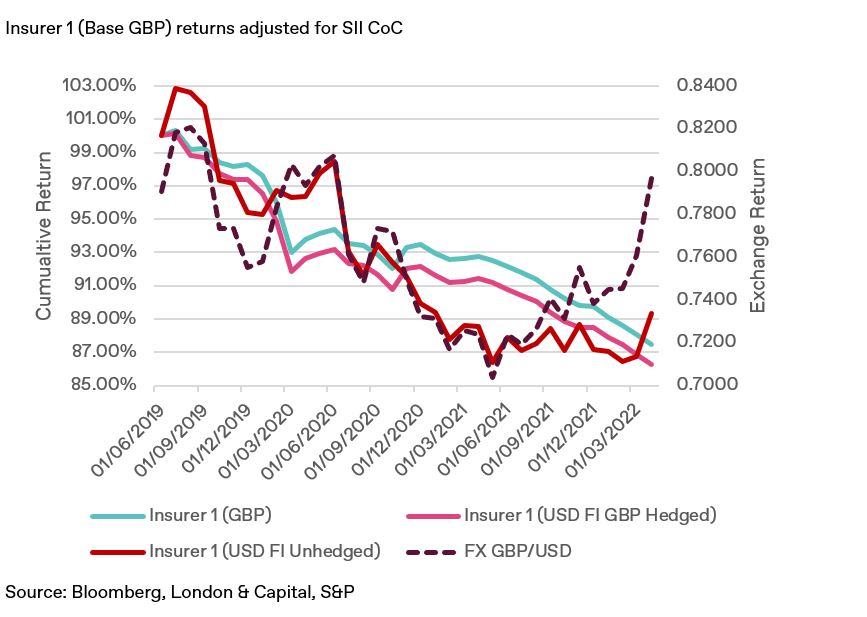

Unsurprisingly, for Insurer 1, there would have been a material benefit from holding an unhedged USD fixed income position compared to holding GBP fixed income or fully currency hedged USD fixed income. The hedging costs eat away at return resulting in no material benefit from the higher yields on offer. However, the unhedged position comes with significant volatility due to the noise in the GBP/USD exchange rate.

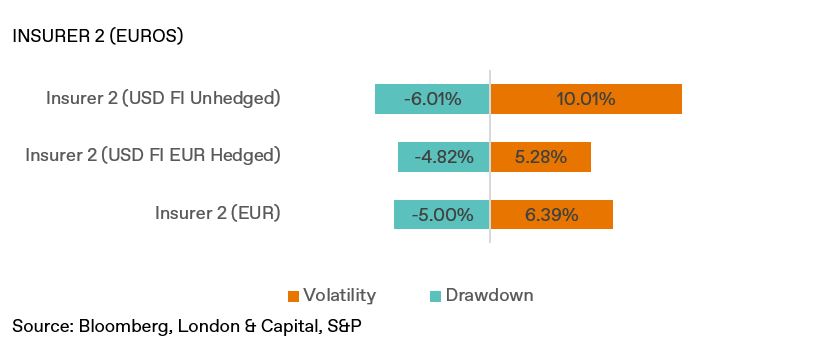

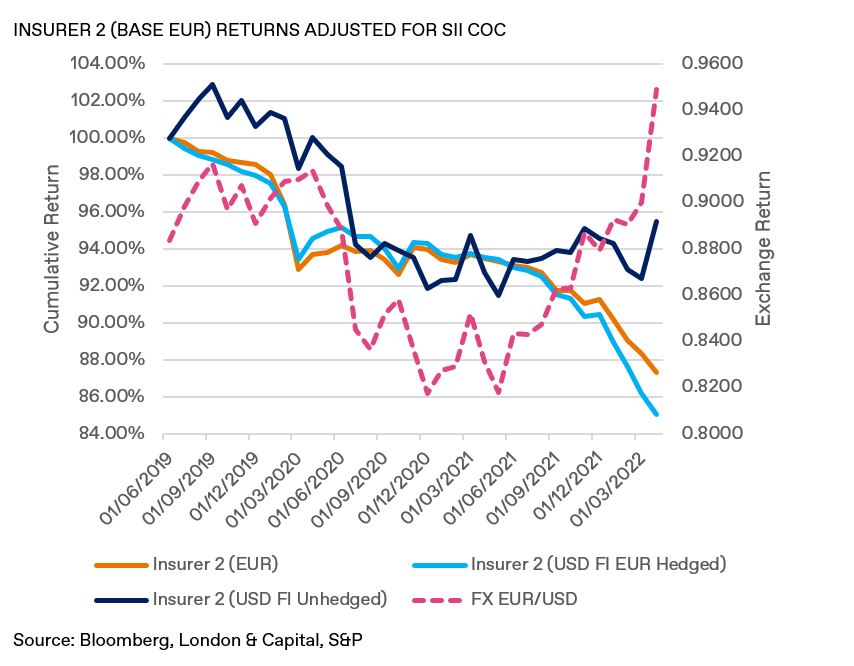

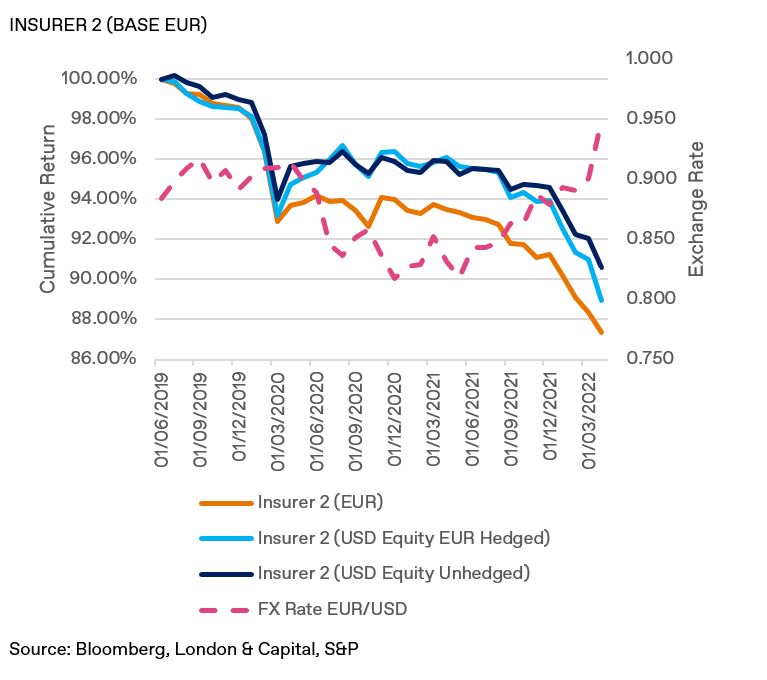

A very similar picture plays out with Insurer 2 in the EUR market. Significant potential gains coming along with material volatility. The chart below summarises the volatility of the different strategies.

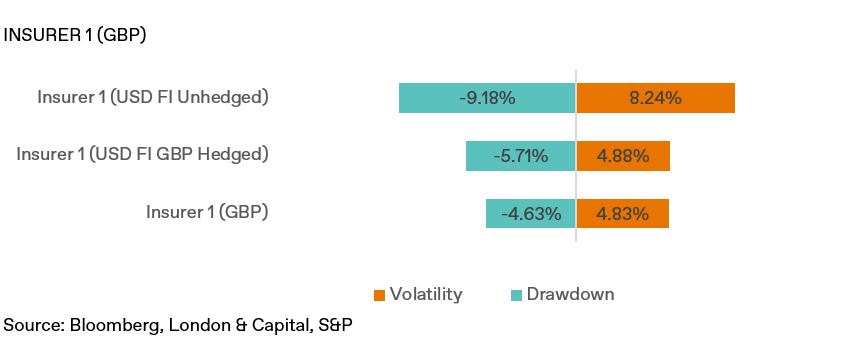

We can see that the volatility introduced by the unhedged currency risk is material as a result of a strong correlation between the fixed income portfolio and the spot exchange rate. For insurers, this would be at odds with the ultimate purpose of the fixed income portfolio which is to hedge the insurance liabilities. This type of volatility will result in large mismatches between the insurance assets and liabilities, impacting on both insurers’ balance sheets and P&L. The insurers would need to have a significant risk appetite to be willing to take this level of P&L volatility. We also note the much higher maximum drawdown for the unhedged positions relative to the hedged and base currency positions. A further reflection of the volatility impact of taking on the FX risk. An insurer may partially mitigate the unhedged FX risk by scaling back the allocation of fixed income assets in the unhedged portfolio. This would still leave the proportion of unhedged FX fixed income assets vulnerable to high volatility hence a sufficiently high return would be expected to justify the strategy.

For insurers operating in Europe and the UK the story does not stop at the investment risk and return because of the impact of regulatory capital when making investment decisions. In this case one would have to consider the impact of any additional Solvency Capital Requirements (SCR) on the profitability of a strategy. At L&C we apply a measure we call the net cost of capital return (CoC). This measure allows us to compare the relative benefits of any investment strategy not only form an economic perspective but also from a regulatory capital perspective. We applied this methodology to the scenarios with results as per the charts below.

Adjusting for the cost of additional SCR (in this case capital charges related to holding unmatched currency positions), the relative gains are muted. There are periods where the unhedged strategy returns compensate for the additional capital cost and vice-versa. As we can see for both portfolios outcomes are highly correlated to FX rates which determine the periods of outperformance and underperformance. Over the last 3 years the net of CoC benefits of taking unhedged fixed income was strongly correlated to the currency returns rather than the fixed income returns. Again, the extent to which this impact is felt will depend on the proportion of total fixed income assets that is devoted to an unhedged strategy.

The hedged positions underperform the base currency positions for the period. This was pronounced for GBP fixed income where the cost of hedging has steadily increased as relative interest rates in the US and UK widen.

In this illustrative case the conclusion is that running an unhedged fixed income strategy is very close to playing the currency market as returns are highly correlated to FX risk. This is because low volatility fixed income returns will be overwhelmed by the highly volatile currency returns. To run such a high risk/return strategy our insurers would need to consider whether any gains from the strategy are sufficient to counteract the economic and regulatory capital costs of running the strategy. In this case the unhedged position has advantages in terms of historical returns but disadvantages in terms of material volatility.

THE ARGUMENT FOR EQUITY

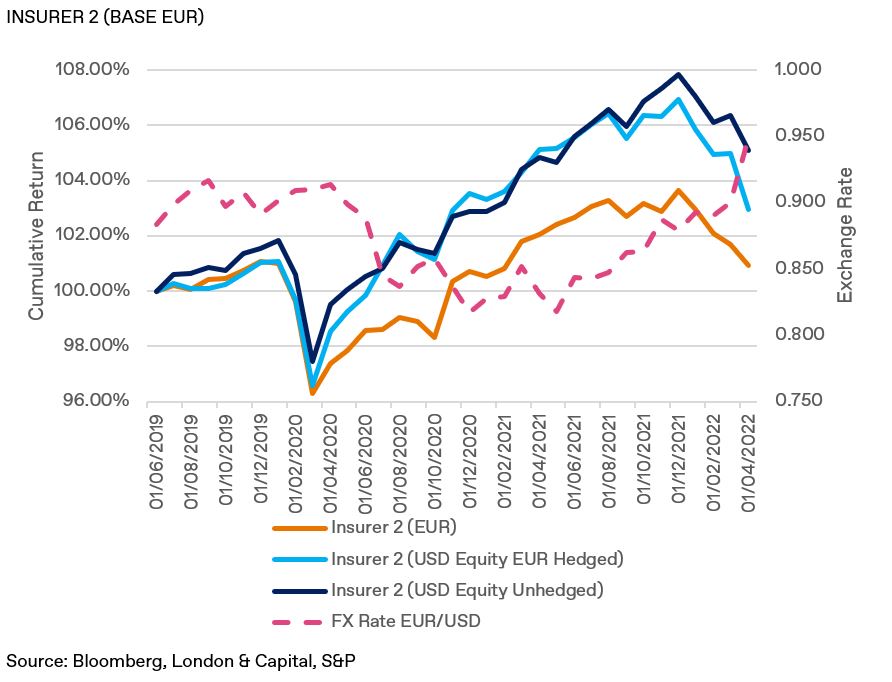

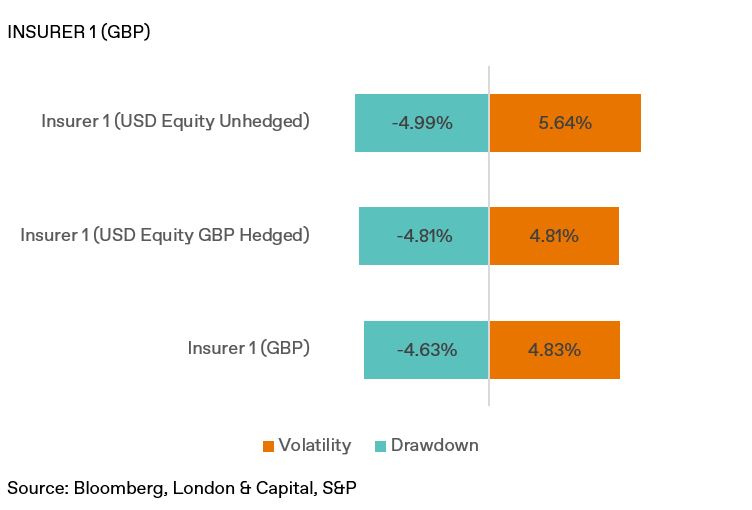

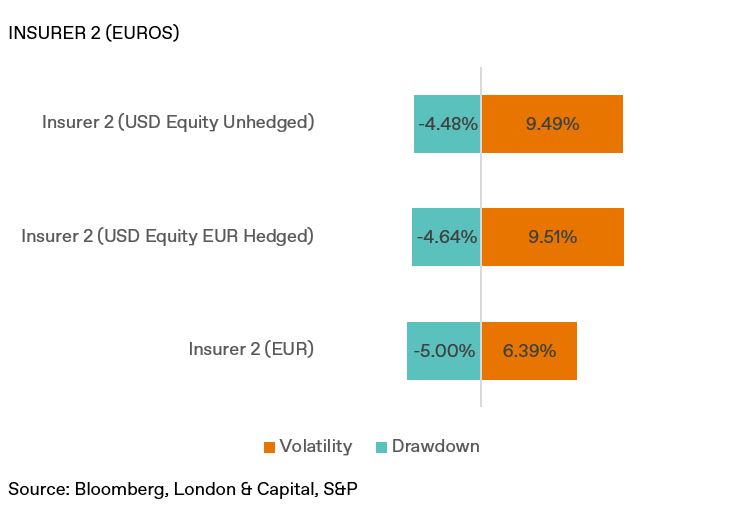

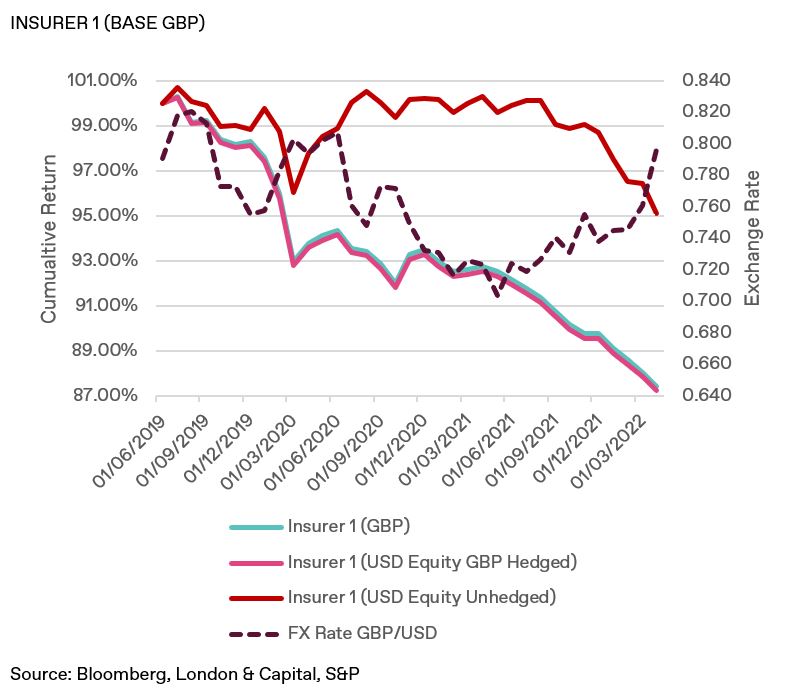

Further to the above 3 scenarios, we performed the same analysis for the equity investments, that is, we analysed the following scenarios:

01 The insurer invests all assets in their base currency market.

02 The insurer invests all equity in the USD market but fully hedges out the currency risk.

03The insurer invests all equity in the USD market with no currency hedging.

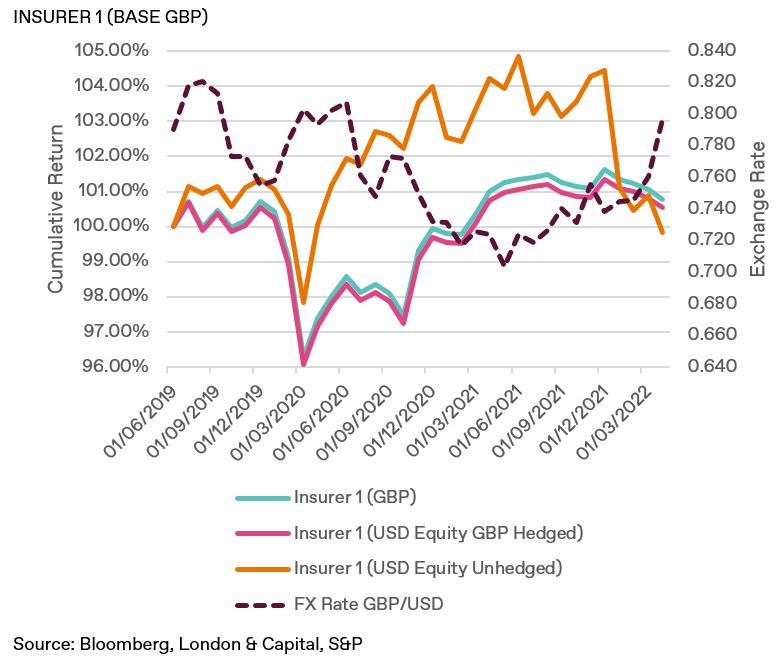

In the equity example we see a negative correlation between the portfolio returns and the exchange rates with the unhedged positions producing higher and noisy returns. The general path appears smoother compared to the Fixed Income example, but this is mostly due to the generally lower allocation to equities relative to fixed income. Currency risk also tends to act favourably with equity allocations especially if an equity portfolio is constructed using large cap stocks with global footprints. In which case, the currency impact can act as a diversifier of risk in the portfolio. This is not often the case with bonds that tend to have much less volatility, especially in the investment grade space. We can see some of this when we compare Insurer 1’s results. The hedged and base positions are very close due to the make-up of the GBP equity market which means there is a large exposure to the dollar in the base GBP market (The GBP large cap equity market is dominated by companies with global operations and markets hence will be receiving majority of their revenue in non-sterling currency and mostly in dollars). Hedging the portfolio merely brings you back to the base currency, a transaction that is priced into the equity returns. This is different for Insurer 2 where we can see a difference between the base position and the hedged portfolio. The hedged portfolio looks more like the unhedged position with some underperformance that reflects the cost of currency hedging. This reflects the Euro equity markets weaker correlation to the dollar compared to the GBP equity market.

For the equity portfolios, as expected, results reflect the nature of the underlying equity markets. For Insurer 1, volatility for the hedged and base position are near identical and for Insurer 2, volatility of the hedged and unhedged position are also close to identical. In both cases the unhedged positions materially increase the overall volatility of the portfolio relative to the base position. However, given that most short-tail insurers match liabilities through their fixed income portfolio, and use equities as a return driver, there may be scope to adjust the risk appetite to accommodate increased equity volatility so long as the core liability matching assets remain stable.

The CoC positions for these scenarios give a different picture compared to fixed income.

In both cases the return net of CoC for the fully unhedged position is higher than the base position. This implies that even after adjusting for the CoC the returns generated from holding unhedged positions compensate for the extra regulatory capital required to maintain the positions.

SHOULD INSURERS TAKE ON FX RISK?

Although the analysis we performed is merely a snapshot of very recent history it illustrates important points for consideration by insurers seeking yield in alternative markets:

01 Short-tail traditional investment grade fixed income portfolios are generally unsuitable for unhedged FX risk as this is likely to introduce volatility and FX correlation. For insurers this can result in heightened P&L volatility due to the liability mismatch depending on the quantum of assets that are delivered into such a strategy.

02 Hedging FX risk in fixed income may produce positive returns but this will depend mostly on the yield differential in the relative fixed income markets

and the relative interest rate dynamics between the currencies. There will be scenarios where the hedging cost is negative (that is relative interest rates produce a positive return for hedging FX risk) but these are likely to be short-lived and will require tactical decisions about asset allocation and hedging ratios.

03 Taking unhedged equity positions can be beneficial as FX can have a diversifying impact on equity returns. Hedging out the FX risk will likely result in minimal benefit for insurers investing in equity markets with a global outlook since the FX costs are often reflected in earnings and by extension equity returns.

04 The additional CoC for taking unhedged FX risk in equity may be compensated by excess returns. This will depend on the return profile, the equity market, the size of the allocation to equities and the cost of capital of the insurer.

CONCLUSION

Our analysis has taken a very small snapshot, during a volatile period in interest rate markets. These conditions will often produce opportunities for insurers to take advantage of dislocations in fixed income and interest rate markets to make excess returns. However, careful consideration of the factors unique to insurers must be taken into consideration when making tactical decisions about FX risk. For the insurers in our example and any similar carriers in the market, considerations around asset-liability matching, FX hedging costs and regulatory capital will be important in determining where to allocate capital and/or take tactical risk.

On average, using equity allocations to take unhedged FX risk may result in better outcomes depending on the target markets. Taking unhedged FX positions in fixed income is likely to produce a portfolio correlated to the FX market. Opportunities will exist to take tactical hedged positions depending on interest rate dynamics. Decisions will also need to be made about allocation of assets into unhedged positions and/or hedge ratios for any FX hedged positions. There is certainly a lot of work that can be done to optimise the hedge ratios in order to maximise expected return and reduce hedge costs as well as regulatory capital requirements.

Insurers need to work closely with their advisors and investment managers to understand the true opportunity cost of making these trade-offs .