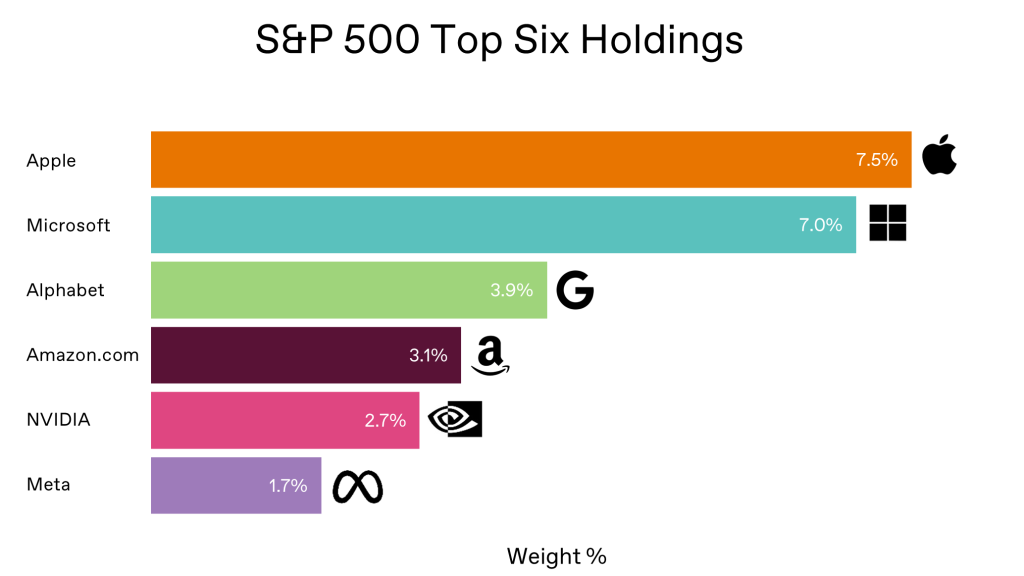

The impressive performance of the six companies holding the highest weight in the S&P 500 has been the driving force behind the index’s returns so far this year.

The S&P 500 Index is an index that tracks the stock performance of 500 of the largest publicly traded companies in the United States. The index has long been regarded as a benchmark for the US stock market, providing investors with insights into both market trends and performance. However, the methodology employed to create the index allows for the largest companies to gain a higher and higher weight in the index as they grow their market cap. This can lead to an outcome where the S&P 500 Index performance becomes less and less representative of the entire constituents’ performance and instead becomes skewed by the largest. Currently, the top six companies account for 26% of the index and, no surprise, they all belong to the same sector: tech.

Source: Bloomberg Finance L.P.

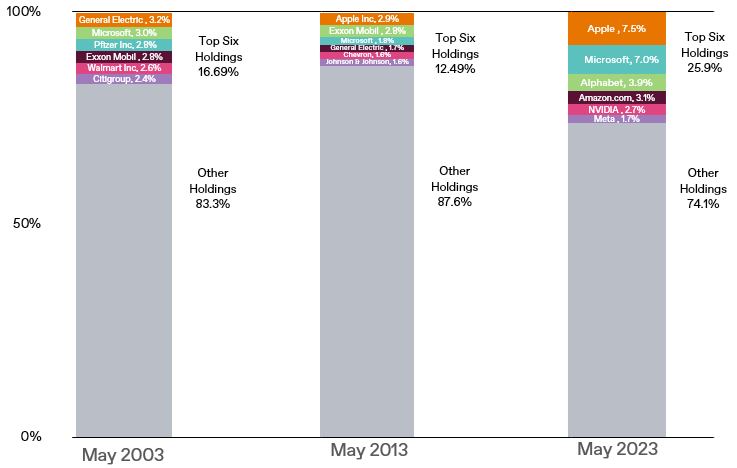

Looking back over the last two decades we can see how the S&P 500 Index has evolved.

Source: Bloomberg Finance L.P.

Although concentration in single stock representation is not a new development, the concentration in one sector is. Both the 2013 and 2003 top holders were spread across multiple sectors: industrial, health care, energy, and tech. This matters even more with a concentration in a sector like tech because it exhibits higher volatility than other more defensive sectors; evidenced by the fact that the S&P 500 ex Tech has a historical beta of 0.83 (a beta less than 1.0 indicates a lower volatility).

How is the S&P 500 Index calculated?

The S&P 500 Index employs a methodology that calculates weightings based on market capitalisation. This means that the weight of each constituent is obtained by taking the market cap of the constituent (calculated by multiplying the number of outstanding shares by the market price per share) as a percentage of the overall index. This approach grants more influence to larger companies, reflecting their significance in market movements.

Why should investors in US companies care more about this now?

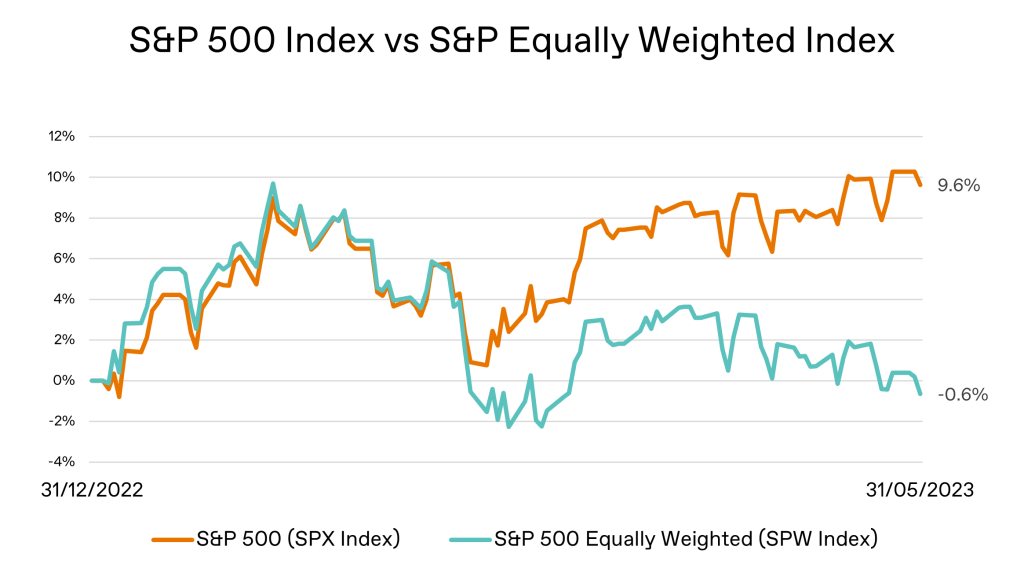

A consequence of the concentration among the top holders is the growing disparity in returns between these companies and the rest of the index. While the index aims to represent the overall market’s performance, the increasing dominance of a select few can result in headline return numbers that may skew investors’ perceptions of the overall performance of US companies.

This year, the disparity between the top six holders and the rest of the index is particularly evident and we can analyse this by drawing comparisons with the Equal Weighted S&P 500 Index. The Equal Weighted Index assigns equal weightings to each constituent, regardless of their market capitalisation. This approach ensures that smaller companies have a more significant impact on the index, balancing out the influence of the larger corporations. By comparing the returns of these two indices, the stark contrast in performance highlights the impact of concentration within the S&P 500 Index.

Source: Bloomberg Finance L.P.

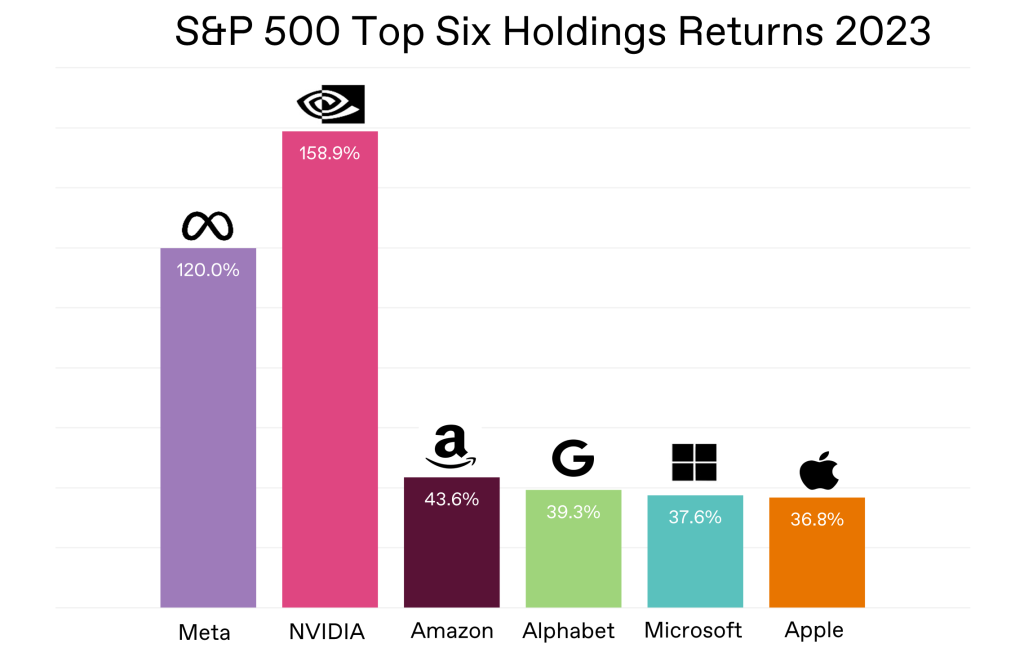

This outperformance of the S&P 500 Index vs the S&P 500 Equally Weighted Index is attributable to the significant outperformance of the top six holdings.

Source: Bloomberg Finance L.P.

At London & Capital, we believe it is important to diversify your portfolio across sectors as well as individual companies. Careful portfolio construction is key to ensuring portfolio returns are in line with our clients’ expectations. Significantly overweighting equity exposure in one particular sector can be hugely detrimental to portfolio performance.

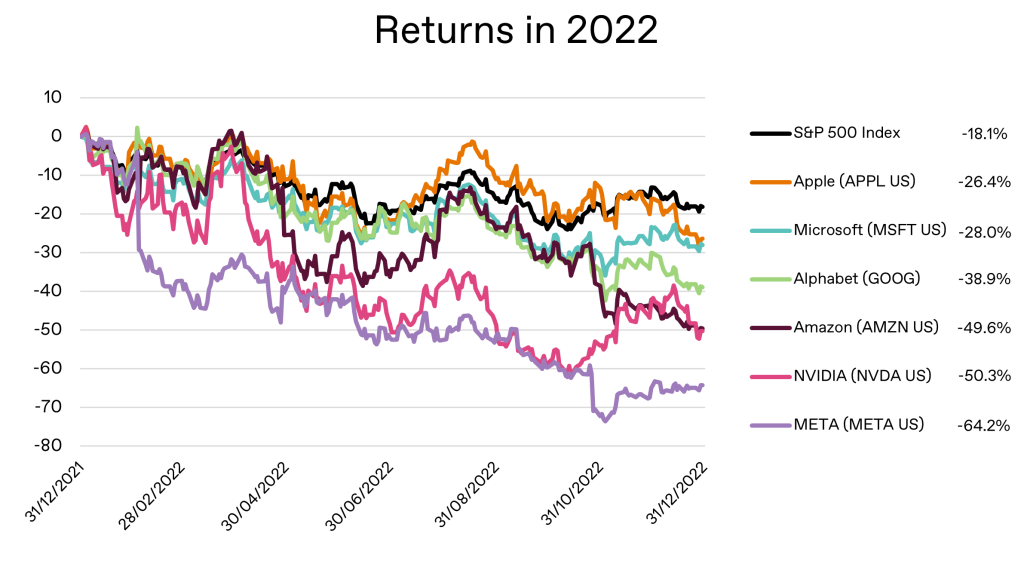

For example, these same companies hugely underperformed the S&P 500 Index in 2022.

Source: Bloomberg Finance L.P.

While the S&P 500 Index remains central for tracking the US market, it is important for investors to recognise that the performance of the constituent companies can potentially lead to skewed perceptions. Understanding the individual companies’ performance and their impact on the index is vital for making informed investment decisions.

If you have any questions on this information, please do not hesitate to reach out.