With the weak pound and rising mortgage rates, it’s a great time to sit down and review your property situation.

Greg Oldfield and Tahir Mahmood discuss the implications of selling a property in the UK as an American.

01. Mortgage Rates

In an attempt to curb soaring inflation, we have seen the Bank of England raise the UK base rate 5 times in 2022 alone taking the base rate to 2.25%. As a direct result of increased rates, lenders typically pass on the increase in the base rate to their customers in the form of higher monthly payments.

So, what does this mean.

Individuals on a fixed rate mortgage would not be impacted. Variable rate payers could have seen their monthly payments (take a £1m mortgage) from around £1,600 a month to over £4,000. For individuals with a high mortgage balance this could push you from an affordable to an unaffordable situation very quickly, do you have to consider selling your property? Or downsizing?

02. Selling a property in the UK

UK Rules

In the UK, individuals benefit from Principal Private Residence (PPR) relief. This allows individuals to sell their main home and pay no capital gains tax, assuming a few conditions on occupation are met.

US Rules

Unfortunately, the Americans amongst us have another set of rules to play by. The Internal Revenue Service (IRS) has a worldwide reach on US citizens’ tax affairs, and the gain made on the sale of the family home, i.e. the main residence, is potentially subject to capital gains tax in the US.

Currently, the first $250,000 of the gain (per individual) is exempt, but the excess is taxable as a capital gain.

Unfortunately, the complications don’t stop there, we now have to look at currency.

03. Currency Effect

With the recent swings in currency, it is imperative that you understand the implications to you.

UK Property

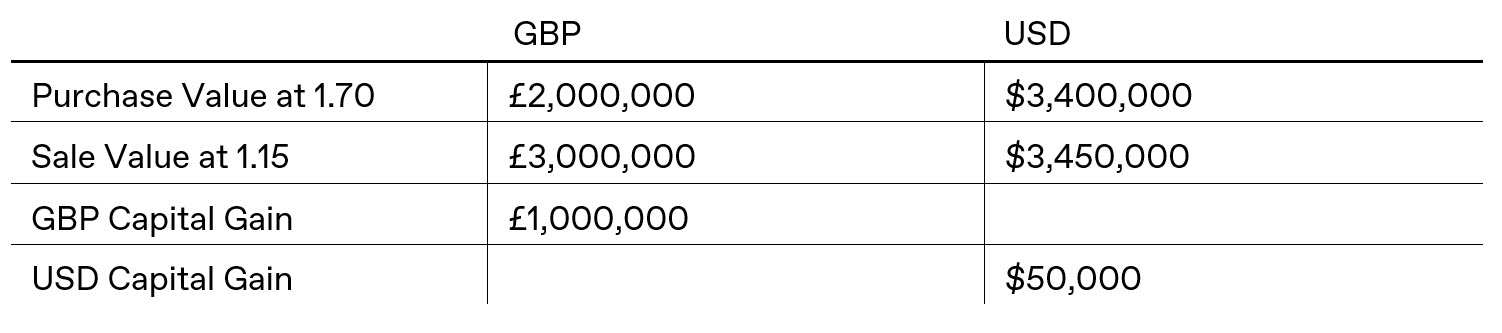

By way of example, let’s assume a US individual and taxpayer owns a house in the UK with a value of £2,000,000.

Although the Pound has depreciated against the US Dollar in the above scenario, due to the UK’s Private Residence Relief, no capital gains will be due from HMRC’s perspective. Additionally, the USD capital gain has been largely diminished through the effect of GBP depreciating against the US Dollar from 1.70 to 1.15 however the USD gain of $50,000 will still be subject to US tax.

US Property

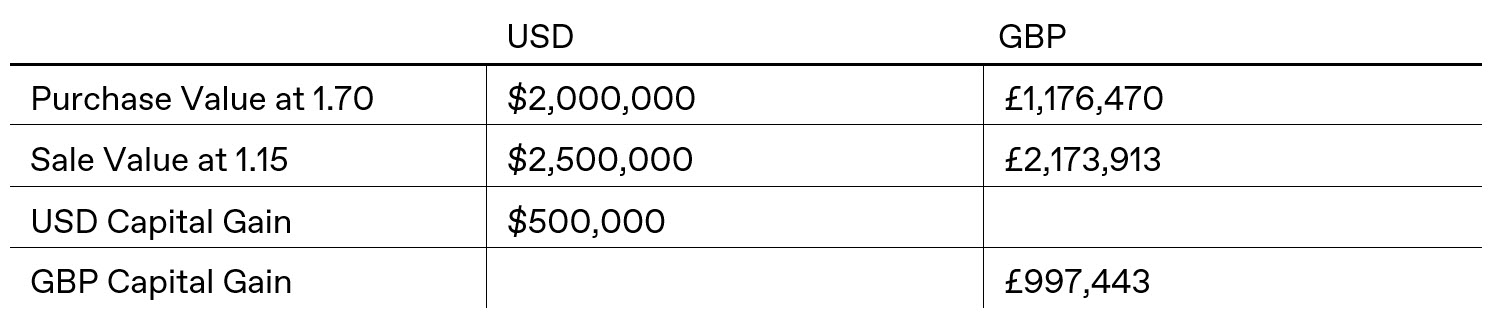

The real problem arises when you have a USD asset in a weak Pound environment as illustrated by the below example:

In this situation, although the USD gain is only $500,000 the resulting GBP gain has been substantially increased to £997,443 as a result of USD strengthening relative to the GBP.

04. Phantom Mortgage Gain – What is it?

Mortgage Gain

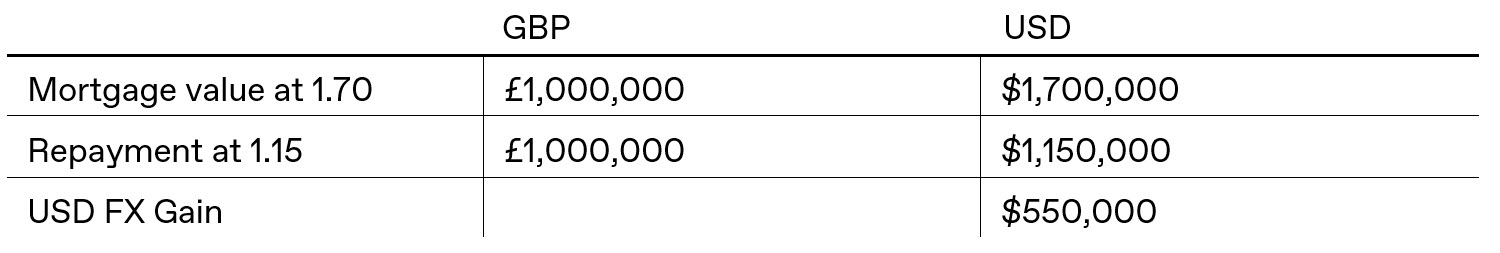

Quite surprisingly, the potential pitfalls don’t stop there. If a mortgage is held, you might naturally assume that the debt is deducted from the asset value to reduce the potential gain. However, the mortgage is in fact considered separately to property.

The IRS, interested only in USD equivalent values, will view the above scenario as an individual having taken out a mortgage of $1,700,000 only to have repaid $1,150,000 at a later date and thus benefitting from repaying a lower amount (in USD terms) than initially having taken out and this will be subject to US tax at ordinary income rates.

Mortgage Loss

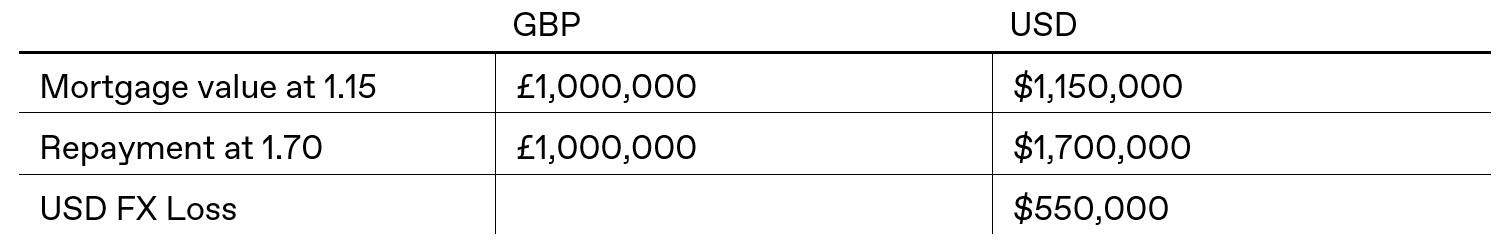

Unfortunately, the bad news doesn’t end there.

In the event that the above scenario is reversed, i.e., initial mortgage of £1m was taken out at a GBP/USD rate of 1.15 and later repaid at 1.70, the $550,000 ‘phantom loss’ in this instance, is viewed by the IRS as a ‘personal loss’ and as such, not deductible.

Clearly, careful attention and planning needs to be paid when considering capital repayments of outstanding debt.

Effective tax planning and advanced wealth structuring are critical components of preserving and growing your wealth. Our approach is rooted in providing you with the tools and strategies to optimise your financial situation. Should you have any inquiries regarding tax planning, please feel free to get in touch with our Tax & Advanced Planning team.

PLEASE NOTE: We do not provide tax advice, we collaborate with you and your London & Capital Adviser to structure your wealth in the most tax-efficient way possible.