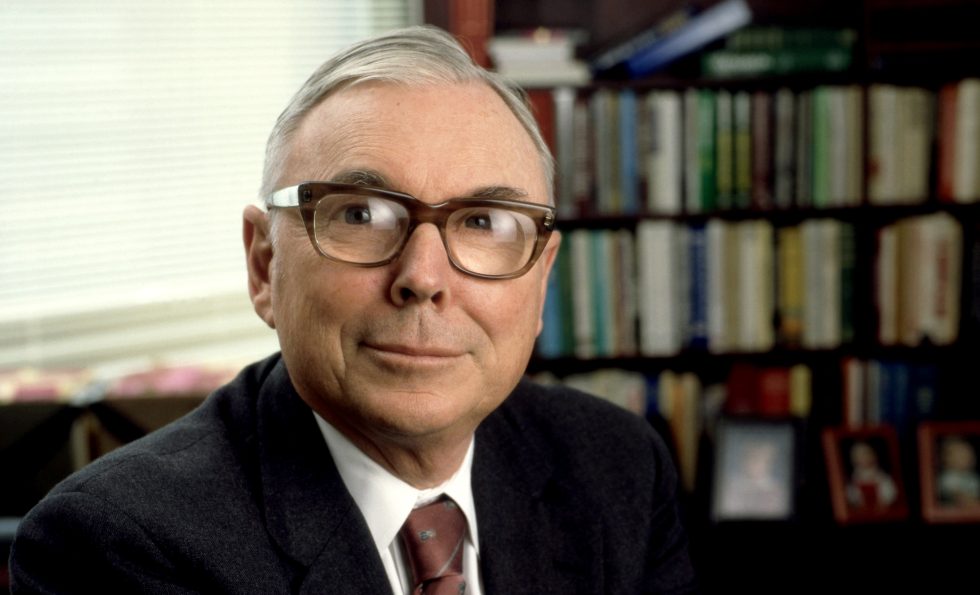

Charlie Munger (Berkshire Hathaway vice-chair) died this week.

Many of you might not have heard about him, but I am not exaggerating when I say that, as well as being an amazing investor (him and Warren Buffett turned Berkshire Hathaway into an investment giant) he had a truly beautiful mind.

Our Equity STAR framework incorporates many concepts present in Berkshire Hathaway’s approach, so (as a tribute and thanks) please allow me to share with you some high (and low) lights of his life.

Raised in the great depression, and after fighting in WW2, Munger divorced at age 29. His wife kept the family home upon divorcing, so Charlie’s only remaining possession was a banged up yellow Pontiac. Shortly after the divorce, Charlie learned that his son, Teddy, had leukemia. In those days, there was no health insurance and the death rate was near 100%. Munger would go into the hospital, hold his young son, and then walk the streets of Pasadena crying. One year after the diagnosis, in 1955, Teddy Munger died.

By 31 years old, he was divorced, broke, and burying his 9 year old son. Not long after, he faced a surgical operation that left him blind in one eye (with pain so terrible that he eventually asked to have his eye removed). Around that time, he met Buffet and the rest is history…

At 69 years old, he became one of the richest 400 people in the world, been married to his second wife for 35+ years, and had eight children.

Munger credits his success to always following these very simple rules:

- Keep expectations low

- When you are hit with reversals, suck it up and move on

- Keep things simple

- Avoid folly

- Be cheerful

- Accept delayed gratification

- Be sensible, but grab opportunity fiercely when it comes

- Enter finance like an engineer rather than a speculator

Beyond investing and business, Charlie teaches us about resilience, dignity, and life well lived. Rest in Peace.