You have packed your bags, said goodbye to the place you have called home for the past ten years, and made the move to the UK, land of drizzle and double-decker buses. Welcome (or welcome back)! HMRC has a shiny new tax regime just for you — and it is called the Foreign Income and Gains regime, or FIG.

What Is the FIG Regime?

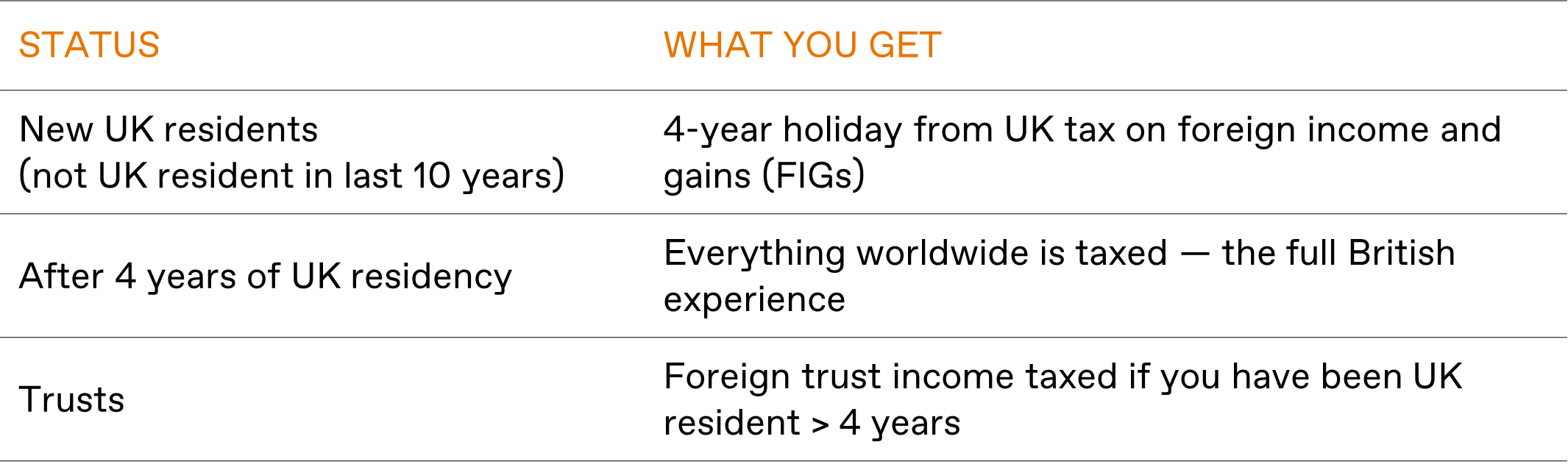

From 6 April 2025, the UK has said farewell to the old “non-dom” tax rules. Now, it does not matter if you have a strong domicile connection elsewhere as it is all about residency.

Transitional Relief

HMRC is not just cutting the cord on current non-doms. They are offering transitional measures to ease the pain:

- Temporary Repatriation Facility: bring your foreign income into the UK at just 12% tax in 2025/26 and 2026/27, then 15% in 2027/28. After that the relief goes.

- Capital gains rebasing: you can revalue foreign assets to their April 2019 value, which could significantly reduce your capital gains tax liability.

Opportunities to FIG-ure Out

- Time your arrival: if you have been away from the UK for close to 10 years, it might be worth staying out for a little longer to qualify for the regime.

- Tax-free gains: if you have large offshore gains, these can potentially be fully exempt from tax if you time the sales right.

- Use the TRF: get foreign income into the UK at low rates — this is only a short window so plan in advance and look at your longer-term intentions.

- Rebase wisely: revaluing your assets could save tens or even hundreds of thousands in tax later.

- Returning expats: many Brits believe they’re not eligible for the FIG regime after living abroad for 10 years, but in reality, they are entitled to it.

Case Study

Background: Carlos is a UK citizen who left the UK in 2015 to work in Dubai. He’s been living there for 10 years, enjoying tax-free income and investing his earnings into offshore funds and property. In 2025, he’s planning to return to the UK with his family for good. He has:

- £1 million in offshore investments, which have grown significantly since he left

- £200,000 in foreign income expected in 2026 from dividends and rent

- 4-Year FIG Holiday

Because Carlos hasn’t been UK resident for the last 10 years, he qualifies for the FIG regime.

That means:

- He can keep his foreign income and gains outside the UK tax net for 4 years (2025–2029)

- He can use this time to restructure, reinvest, or spend offshore

- Temporary Repatriation Facility (TRF)

Carlos does not get access to the TRF, as he is a British citizen he never earned income under the remittance basis.

- Capital Gains Rebasing

One of Carlos’s offshore investment funds has gained £500,000 since he bought it in 2012. Under the FIG transitional rules:

- He can rebase the value of that asset to its market value as of April 2019

- Let’s say the asset was worth £700,000 in 2019 and is now worth £1.2M

- Instead of being taxed on a £700,000 gain, he is taxed only on the £500,000 gain since 2019, or potentially £0 if sold within his first 4 years

Final Thoughts

The FIG regime represents the most significant reform to non-dom taxation in decades. It is fairer, more straightforward (to some extent), and characterised by several quirks.

If you are planning a move to the UK or already here and wondering what to do with your offshore funds, now is the time to act.